31 March 2025 marks the 35th anniversary of a huge national march in London to protest about the imposition of the poll tax. People’s History Museum’s (PHM) Collections Manager, Lisa Peatfield looks at what the poll tax was, and the actions people took to protest against the Community Charge during the early months of 1990.

The poll tax – officially called the Community Charge – was introduced by the Conservative government in 1989 /1990 to replace the existing system of domestic rates that was in place to fund council services. The tax was introduced first in Scotland, in 1989, and in England and Wales the following year. The tax earned its nickname from previous taxes levied on a per head basis, such as the poll tax of 1381, which was a cause of the Peasants’ Revolt of the same year.

The poll tax (Community Charge) represented a shift from funding local services via the rates system, where home owners were charged a variable amount based on the value of their property, to a flat charge payable by almost every adult. Critics of the rates system argued that a family with school age children paid the same amount as a single pensioner living in a house of the same value despite the former being likely to use more council services, including schools, than the latter. The poll tax required people to pay the same amount on an individual basis, largely irrespective of means. People on the lowest incomes were entitled to relief of up to 80% of the Community Charge, but that still meant that many people now had to pay towards council services where previously they had not.

For the Conservative government who introduced the poll tax it was a point of principle that everyone should contribute to funding council services on an equal basis. “Why should a duke pay more than a dustman? It is only because we have been subjected to socialist ideas for fifty years that people think this is fair” opined Conservative minister Nicholas Ridley MP in 1988. The government also sought to solidify the link in people’s minds between high spending, mostly Labour, councils and the size of the Community Charge people had to pay. Lower spending councils, mostly in affluent Conservative-voting areas, were able to levy a lower charge on their residents.

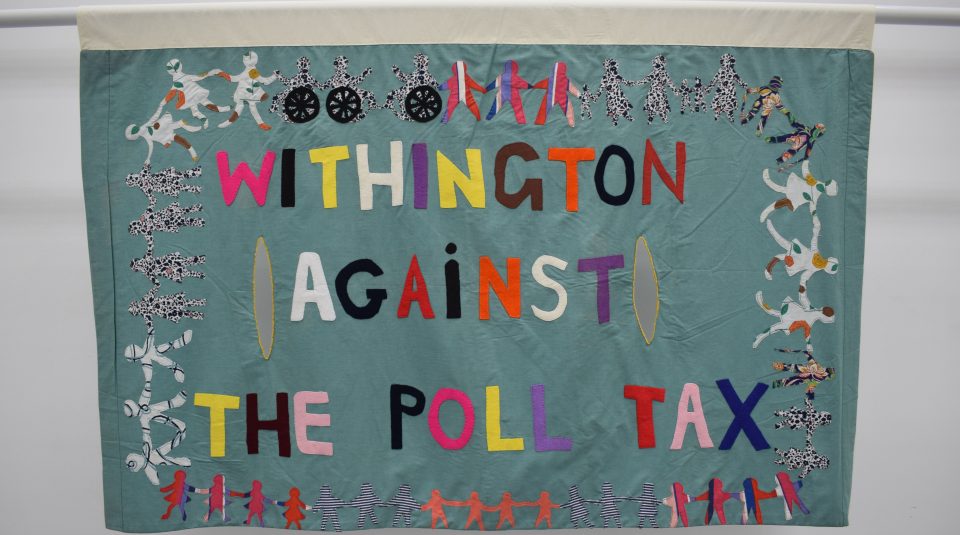

The introduction of the poll tax (Community Charge) was met with fierce opposition. Many people considered the tax to be unfair and unaffordable. Anti-poll tax unions were set up across the UK (except Northern Ireland which did not have the tax) to campaign against the Community Charge.

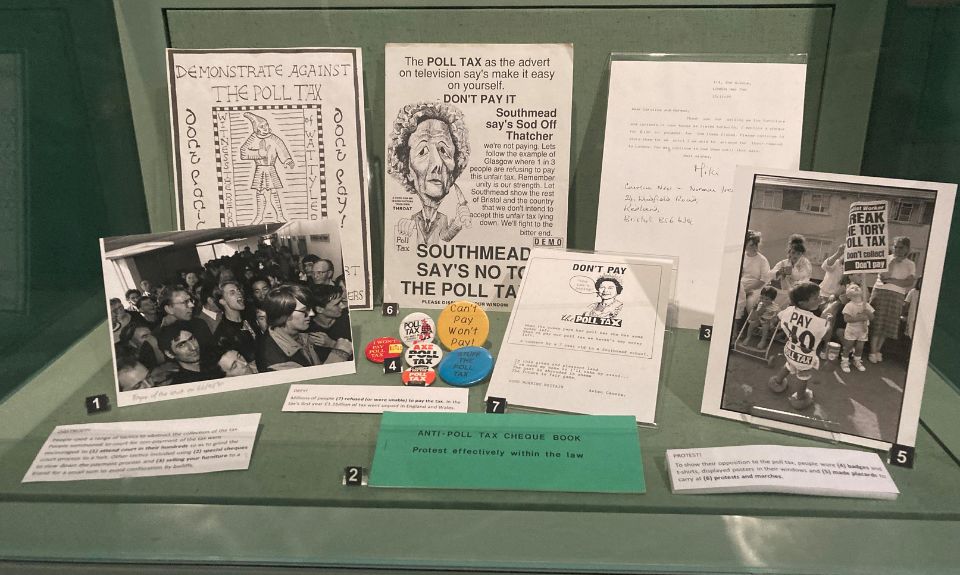

Millions of people refused (or were unable) to pay the tax. In the tax’s first year £1.2billion of tax went unpaid in England and Wales. People used a range of tactics to obstruct the collection of the tax. Individuals summoned to court for non-payment and Community Charge arears were encouraged to attend court in their hundreds so as to grind the court process to a halt. Other tactics included using special cheques to slow down the payment process and selling your furniture to a friend for a small sum to avoid confiscation by bailiffs. An estimated one million people removed their names from the electoral roll in a bid to avoid the tax with clear consequences for the operation of local democracy.

Anti-poll tax protesters held protests and marches culminating on 31 March 1990 with a protest march in London attended by at least 100,000 protestors. The march ended with violence between police and some protesters, with over 400 arrests and over a hundred people injured.

It is widely accepted that the poll tax contributed to Prime Minister Margaret Thatcher’s resignation in November 1990. Her successor, John Major, replaced the poll tax (Community Charge) with the Council Tax, which takes into account property values, the system that remains in place today.

Visit some of the objects described in this blog on display in the Collection Spotlight case in Gallery One and the museum foyer from 26 March 2025 until 29 September 2025. This display case showcases objects from the museum’s collection that are not on permanent display. The case is changed regularly to share new acquisitions and explore ideas worth fighting for.

Read From the collection: heritage treasures a blog showcasing treasures across three centuries in PHM’s collection.

Keep up to date with PHM’s latest blogs and upcoming events by taking the Radicals quiz to sign up to our regular e-newsletter.